The Export-Import Bank of the United States (or EXIM, as it is usually called), is the export credit agency of the United States. It supports employment and exports by providing financing for transactions that would otherwise not occur because commercial lenders are either unable or unwilling to accept their inherent political or commercial risks.

The agency was established in 1934, and it has been critically important to the United States, both at home and abroad. EXIM, for example, financed the Pan-American highway, which runs from Alaska to Chile. It ensured that the Burma Road, an essential supply route to China during World War II, remained open by providing the transport vehicles and support material to operate it. Between 1945 and 1949, EXIM provided record amounts of financing to European countries to aid in their reconstruction efforts, helping secure the peace. When the Berlin wall fell and the U.S.S.R. disappeared, EXIM was there, opening markets to U.S. exporters.

What products does EXIM offer?

EXIM provides buyer and supplier credits within the OECD framework. These are their main products:

Buyer credits:

EXIM provides loan and capital market bond guarantees and direct loans to buyers of U.S. goods abroad. Financing tenors can generally be for up to 10 years, but in some cases they can be much longer. For example, renewable power and nuclear plants financings can have tenors of 18 years.

The agency can provide corporate financing on the strength of a borrower’s balance sheet, sovereign financing on the basis of a country’s full faith and credit, and project financing on the basis of a project’s future cash flows, provided that all risks have been adequately mitigated. It also provides medium-term financing for finance leases.

Supplier credits:

EXIM provides a range of short-term products, including export credit insurance products that allow exporters to extend longer credit terms to their customers, working capital loan guarantees to U.S. exporters, and performance and bid bonds.

EXIM's special initiatives

EXIM has a number of special initatives that greatly broaden the agency's level of support for U.S. exporters:

Domestic finance - Make more in America:

EXIM is making available the agency’s existing medium- and long-term loans, loan guarantees, and insurance to export-oriented domestic manufacturing projects. The new tool will be open to all sectors, with financing priority available to environmentally beneficial projects, small businesses, and transformational export area transactions.

Transaction eligibility is determined by the percentage of production or shipments tied to exports. For most projects, the required export nexus is 25%, but it is lowered to 15% for small businesses (including minority and women-owned business), transformational export areas, and climate-related transactions.

The amount of EXIM financing made available for individual projects will be scaled based on the number of U.S. jobs supported, both during construction and over the life of EXIM’s financing.

China and Transformational Exports program:

EXIM offers reduced fees, extended tenors, and exceptions from other EXIM policies for projects in which the U.S. exporter is competing against a Chinese company.

For export contracts in ten transformational export areas, the EXIM eligibility rules have been made more flexible, including support for eligible foreign content.

What are some of the particularities of working with EXIM?

EXIM is compliant with the OECD's arrangement on officially-supported export credits. Thus, its products share some features with those of other ECAs, such as 15% down payments, maximum tenors, minimum pricing, and maximum local content supported. However, beyond these basic features, EXIM is quite unique in several important aspects. The list below is by no means comprehensive, but it provides an idea of some of the unique characteristics of EXIM.

Eligibility:

Many ECAs finance 85% of the value of a supply contract as long as national content is greater than a certain threshold and local content is less than a certain amount. EXIM's eligibility rules are quite different.

The simplified loan calculator below can be used as a guide to determining the financed amount for a buyer credit from EXIM. To view the effect of using different amounts of eligible goods and services, enter them in the textboxes.

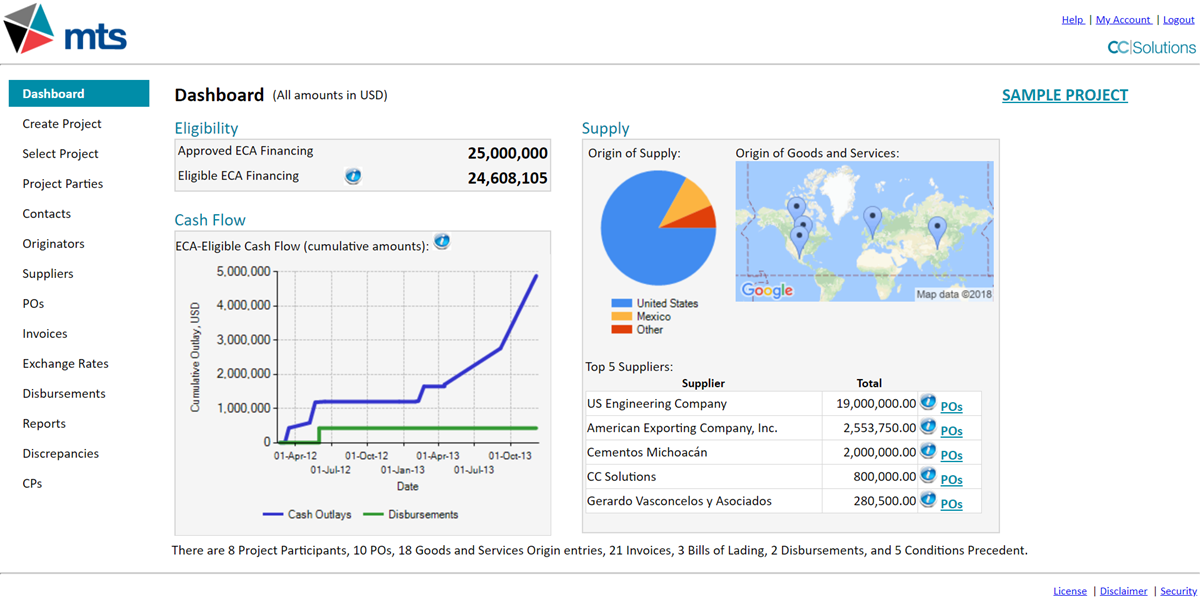

The devil, of course, is in the details, and there are many hidden variables that can affect the eligibility calculations, especially in transactions involving multiple exporters. It is very important to know that regardless of the financing commitment that EXIM made to a borrower, the borrower will only be able to draw funds from the EXIM facility based on the eligibility of actual procurement.

We have provided EXIM eligibility services to borrowers worldwide, and have helped customers significantly increase the amount of EXIM financing before financial closing, and, after financial closing, constantly recalculating eligibility in order to maximize the actual utilization of the financing. Calculating, maximizing, and maintaining EXIM eligibility is one of our core competencies. Our ample experience and intimate knowledge of EXIM eligibility rules can help you maximize your financing and utilization.

Consolidation:

Many ECAs can only cover one export contract in a given financing. EXIM, on the other hand, can cover many export contracts in one transaction. We have actually worked on projects in which EXIM covered hundreds of supply contracts in a single financing.

EXIM's ability of financing several export contracts at a time affords borrowers the opportunity to further maximize financing by appointing an independent consultant, like CC Solutions/Finpliance as procurement consolidator. The procurement consolidator usually does not have a contractual relationship with the exporters, but uses exporter data to calculate consolidated procurement eligbility that can increase the financing amount considerably.

We have had great experience working as an EXIM procurement consolidator; in one case, we were able increase the EXIM financing of a new refinery by almost 10%.

Reachback:

Many ECAs do not finance procurement made before financial closing of the ECA facility (generally known as reachback). EXIM, on the other hand, can. EXIM's reachback policy is very helpful for borrwers, especially for those undertaking large projects, which have long and costly development periods including procurement of long lead items.

We can help borrowers maximize financing by applying our knowledge of the EXIM reachback policy. In a recent oil and gas financing, we prepared and submitted an application for a letter of interest very early in the process, in order to maximize the amount of reachback eligibility.

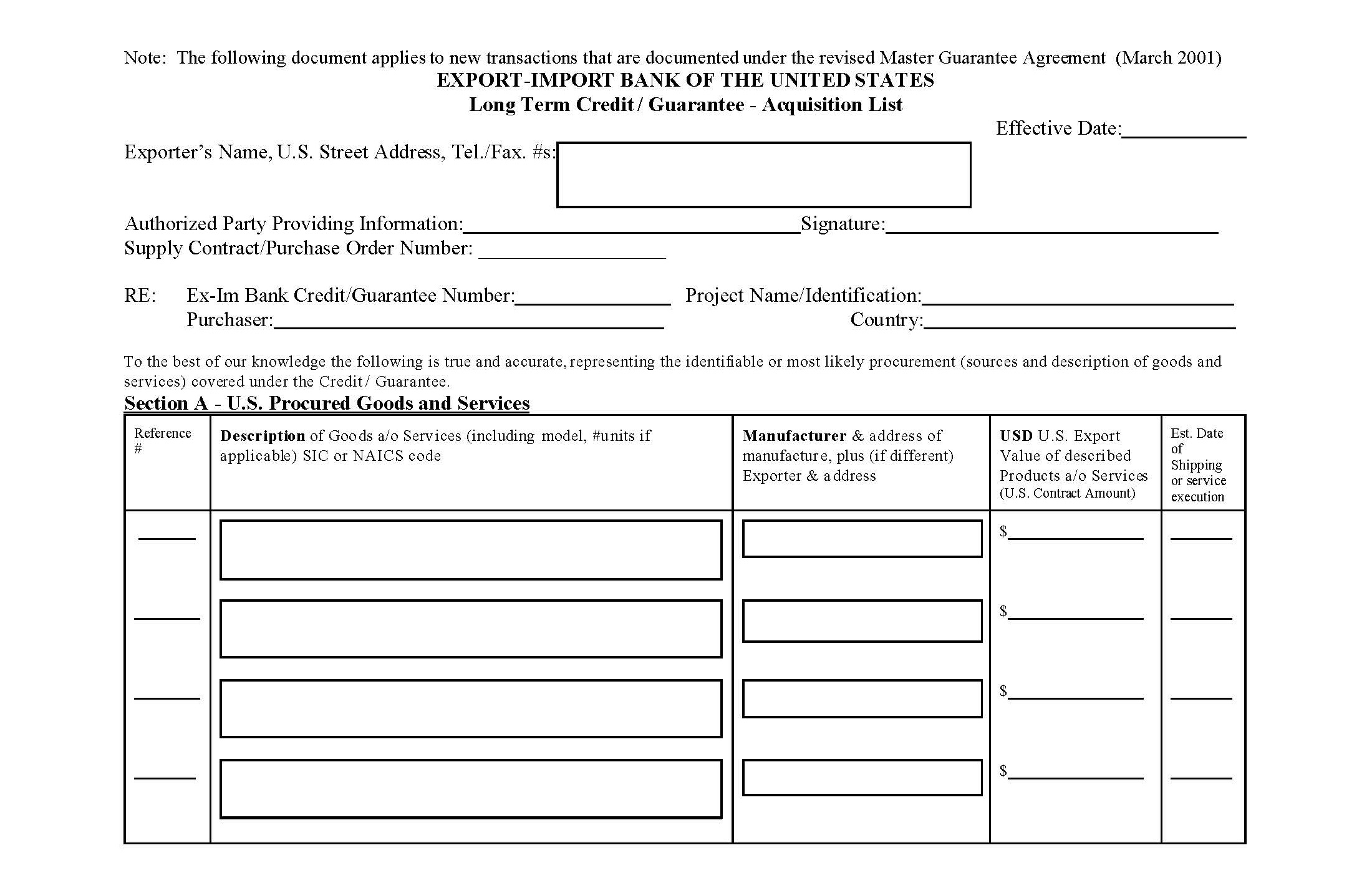

The acquisition list:

The acquisition list is at the heart of EXIM long term financings. It is a menu of sorts of goods and services that may be financed under the EXIM facility. It is common for there to be procurement deviations during project execution. When this happens, it is critical to recalculate eligibility and update the acquisition list accordingly.

Preparing an acquisition list that maximizes financing and is acceptable to EXIM is a complex technical undertaking. We have done this work for numerous projects in many industries all over the world.

Utilization:

Each export credit agency has its own unique utilization procedures. EXIM is no different. Its utilization procedures, though clearly laid out in loan agreements, are very strict. There are documentation requirements from the borrower, the exporters, and other parties, comprising finance, procurement, and logistics information. Because EXIM can finance a bundle of export contracts under one facility, disbursement packages can be quite large. Disbursement packages are furthermore reviewed in great detail, and discrepancies can result in disbursement delays and even in the borrower not being able to utilize the entire facility. Like other ECAs, EXIM can audit borrowers' records to ensure compliance with utilization requirements.

We prepare disbursement packages and manage the disbursement proccess for EXIM financings. Our proprietary loan disbursement system calculates eligibility in real time, automates the core of the disbursement package preparation process, and prepares documents ready to be uploaded to EXIM's own online disbursement management system. We have used our proprietary system to disburse billions of USD EXIM facilities for customers large and small worldwide. We can help you maximize the quick utilization of your EXIM facility. Our systems and processes also help maximize accuracy and transparency.

Shipping:

For EXIM financings larger than USD 20 million, U.S. law requires that seaborne cargo financed directly or indirectly by EXIM ship in U.S. flag vessels. Adherence to MARAD’s cargo preference rules is critical to maintaining the financial eligibility of US procurement in accordance with approved lending amounts.

We have had considerable success facilitating waiver commitments for over USD 200 million of EXIM-financed cargoes, preparing necessary monthly shipping reports, and developing shipping plans that meet project schedule.

We are one of the foremost independent ECA consultants, and have had a great deal of experience with EXIM, including in some of the largest and most complicated projects it has financed in recent times. Please do not hesitate to contact us if you would like additional information.